PMA Company Benefits: Why Foreign Investors Choose Indonesia

Foreign investors looking to expand their businesses often turn to Indonesia due to its strategic advantages as a hub for investment. Establishing a PMA (Penanaman Modal Asing) company, which is a foreign direct investment (FDI) company in Indonesia, offers several key benefits. This article explores the reasons why Indonesia is an attractive destination for foreign investors and how setting up a PMA company can be advantageous.

1. Access to a Large and Growing Market

Expanding Market Reach

Indonesia, as the fourth most populous country in the world with over 270 million people, presents a vast consumer market. By setting up a PMA company, foreign investors gain direct access to this sizable market, offering numerous opportunities for growth and expansion. The country’s growing middle class, urbanization, and increasing disposable income further enhance market potential.

Strategic Location

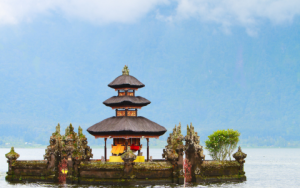

Located in Southeast Asia, Indonesia serves as a strategic gateway to other emerging markets in the region. Its geographical positioning provides investors with access to regional trade routes and neighboring countries, making it an ideal base for regional operations.

2. Tax Incentives and Financial Benefits

Tax Holidays and Allowances

The Indonesian government offers various tax incentives to attract foreign investment. These include tax holidays and tax allowances for eligible PMA companies. Tax holidays can reduce corporate income tax rates to zero for a specified period, while tax allowances provide deductions on investments and operational expenses, reducing overall tax liability.

Investment-Linked Benefits

PMA companies may benefit from additional incentives based on the type and scale of their investment. For instance, investments in certain sectors, such as manufacturing, infrastructure, and technology, are eligible for preferential tax rates and other financial benefits.

3. Favorable Regulatory Environment

Streamlined Investment Procedures

The Indonesian government has been actively working to simplify and streamline investment procedures. Agencies like the BKPM (Investment Coordinating Board) play a crucial role in facilitating the registration and licensing process for PMA companies. This reduced bureaucratic burden allows investors to focus on business operations rather than getting bogged down by regulatory complexities.

Supportive Policies

Recent reforms and policies have been designed to create a more investor-friendly environment. This includes the Omnibus Law on Job Creation, which aims to reduce regulatory hurdles, improve labor market flexibility, and enhance business competitiveness. These changes help create a more predictable and stable regulatory environment for foreign businesses.

4. Skilled Workforce and Competitive Costs

Availability of Skilled Labor

Indonesia boasts a young and dynamic workforce with growing expertise in various sectors, including manufacturing, technology, and services. The country’s emphasis on education and vocational training helps ensure a steady supply of skilled professionals who can contribute to business success.

Cost-Effective Operations

Operating costs in Indonesia, including labor and production costs, are relatively lower compared to many developed countries. This cost-effectiveness can significantly enhance profitability and offer a competitive edge for businesses looking to optimize their operations.

5. Investment in Infrastructure

Improving Infrastructure

Indonesia has made significant investments in infrastructure development, including transportation networks, ports, and industrial parks. These improvements facilitate better logistics and supply chain management, enhancing the operational efficiency of PMA companies.

Developing Industrial Zones

Special Economic Zones (SEZs) and industrial parks provide additional benefits, such as ready-to-use facilities, favorable business conditions, and logistical support. These zones are designed to attract foreign investment and offer various incentives to businesses operating within them.

6. Opportunities for Partnership and Growth

Joint Ventures and Partnerships

Foreign investors have the opportunity to form joint ventures and partnerships with local businesses, which can provide valuable market insights and facilitate smoother entry into the Indonesian market. Such collaborations can enhance market presence and operational success.

Government and Institutional Support

The Indonesian government and various business organizations offer support and resources to foreign investors. This includes advisory services, market research, and networking opportunities that can aid in business development and growth.

Establishing a PMA company in Indonesia offers numerous advantages for foreign investors, including access to a large and growing market, tax incentives, a favorable regulatory environment, and cost-effective operations. The country’s strategic location, skilled workforce, and ongoing infrastructure development further enhance its appeal as an investment destination.

By leveraging these benefits, foreign investors can tap into Indonesia’s vast potential and establish a successful business presence in one of Southeast Asia’s most dynamic economies. Whether you are considering entry into the Indonesian market or looking to expand your existing operations, Indonesia’s PMA framework provides a solid foundation for achieving your business goals.

- WhatsApp: +6281289462599, +6281272222729

- Telegram: azrapradipasolusi, azra_togi