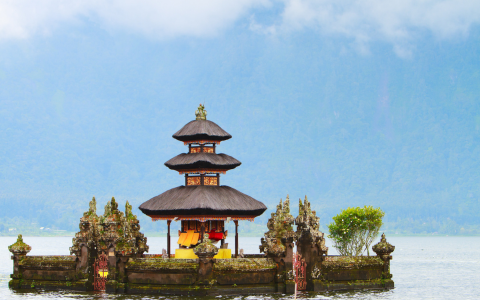

Expanding your business to Indonesia offers immense opportunities due to its growing economy, strategic location, and large consumer market. However, navigating the legal landscape can be challenging. Here’s a guide to help you understand the legal considerations and best practices for a successful business expansion to Indonesia.

1. Understand the Business Structures

Indonesia offers various business structures for foreign investors, each with different legal requirements:

- Representative Office (KPPA): Ideal for market research and networking. It cannot engage in direct sales or revenue-generating activities.

- Local Company (PT): Suitable for businesses looking to operate locally with fewer foreign ownership restrictions.

- Foreign-Owned Company (PT PMA): Allows full or partial foreign ownership but comes with specific investment requirements and regulatory compliance.

2. Investment Coordinating Board (BKPM) Approval

Before establishing a PT PMA, foreign investors must obtain approval from the Indonesia Investment Coordinating Board (BKPM). This includes submitting an investment plan and obtaining necessary licenses. Ensure you understand the sector-specific investment regulations, as some industries have restrictions on foreign ownership.

3. Capital Requirements

PT PMA entities have minimum capital requirements, typically USD 700,000 (IDR 10 billion). Ensure your business plan accommodates this requirement and that you are prepared for any additional financial commitments.

4. Legal Documentation and Permits

Establishing a business in Indonesia involves obtaining several legal documents and permits, including:

- Company Deed of Establishment: Notarized and registered with the Ministry of Law and Human Rights.

- Business Identification Number (NIB): Issued by the Online Single Submission (OSS) system.

- Tax Identification Number (NPWP): Required for tax purposes.

- Operational Licenses: Industry-specific licenses based on the nature of your business.

5. Compliance with Labor Laws

Indonesia has comprehensive labor laws protecting employee rights, including minimum wage, working hours, and termination regulations. Understand and comply with these laws to avoid legal disputes. Additionally, consider the requirements for hiring expatriates, including obtaining work permits (IMTA) and stay permits (KITAS).

6. Taxation

Indonesia’s tax system includes corporate income tax, value-added tax (VAT), and various other taxes. As a PT PMA, you will be subject to corporate income tax, currently set at 22%. Ensure you have a robust accounting system in place and consider engaging local tax professionals to ensure compliance with Indonesian tax regulations.

7. Intellectual Property Protection

Protecting your intellectual property (IP) is crucial when expanding to a new market. Register your trademarks, patents, and copyrights with the Directorate General of Intellectual Property (DGIP) to safeguard your business assets.

8. Local Partnerships and Networking

Building strong local partnerships can significantly ease your entry into the Indonesian market. Engage with local businesses, join industry associations, and participate in networking events to establish a presence and gain valuable market insights.

9. Cultural Considerations

Understanding and respecting local culture and business etiquette is vital for success in Indonesia. Take time to learn about Indonesian customs, communication styles, and business practices to build strong relationships and foster trust with local partners and customers.

10. Seek Professional Assistance

Given the complexity of legal and regulatory requirements, seeking professional assistance is highly recommended. Engaging local legal advisors, accountants, and business consultants can help navigate the process efficiently and ensure compliance with all legal obligations.

Best Practices for a Smooth Expansion

- Conduct Thorough Market Research: Understand the local market dynamics, consumer preferences, and competitive landscape to tailor your business strategy.

- Develop a Comprehensive Business Plan: Include financial projections, market entry strategy, and risk assessment to guide your expansion.

- Leverage Digital Tools: Utilize digital marketing, e-commerce platforms, and local social media channels to reach your target audience effectively.

- Prioritize Corporate Social Responsibility (CSR): Engage in community development and environmental sustainability initiatives to build a positive brand image.

- Stay Updated on Legal Changes: Regularly review updates on Indonesian laws and regulations to ensure ongoing compliance.

Expanding your business to Indonesia can be a rewarding venture with the right approach and preparation. By understanding the legal considerations and following best practices, you can establish a strong foothold in one of Southeast Asia’s most dynamic markets.

For personalized assistance with your business expansion, PT. Azra Pradipa Solusi offers expert legal and business advisory services to help you navigate the complexities of the Indonesian market.